|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Credit One Home Loans and Their BenefitsCredit One Home Loans offer a variety of mortgage options for homeowners and prospective buyers. Whether you are purchasing a new home or refinancing an existing loan, understanding the features and benefits of Credit One Home Loans can help you make an informed decision. Types of Loans OfferedFixed-Rate MortgagesFixed-rate mortgages provide stability with consistent monthly payments. These loans are ideal for homeowners who plan to stay in their home long-term and want protection against interest rate fluctuations. Adjustable-Rate Mortgages (ARMs)ARMs typically offer lower initial interest rates compared to fixed-rate loans. They are beneficial for buyers who may move or refinance within a few years. However, it's important to understand that rates can change over time. Benefits of Credit One Home Loans

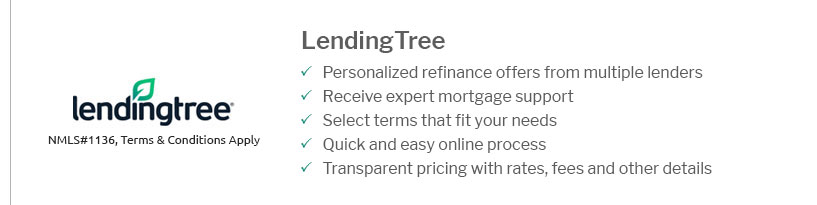

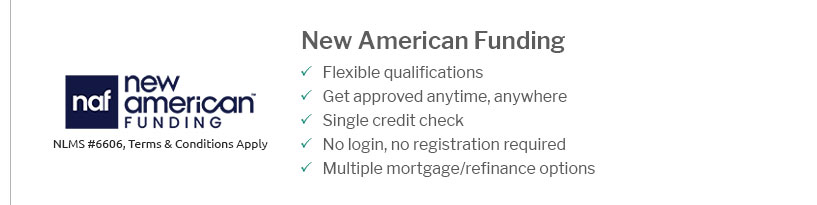

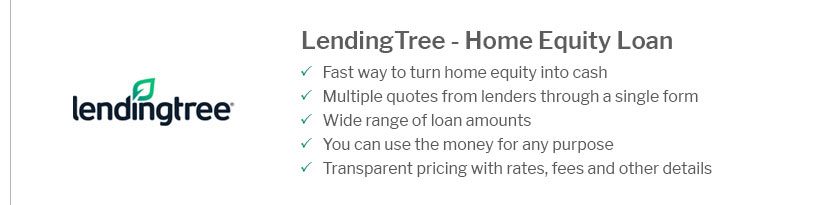

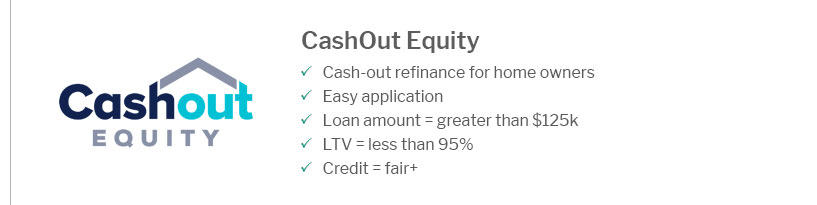

For those interested in exploring options beyond Credit One, consider looking at the best mortgage lenders in Hawaii for localized offers and rates. Refinancing OptionsRefinancing with Credit One Home Loans can help you lower your monthly payments or shorten your loan term. It's essential to compare jumbo refi rates to find the best fit for your financial needs. Cash-Out RefinancingThis option allows you to tap into your home's equity for large expenses, like home renovations or debt consolidation. It's a popular choice for homeowners looking to leverage their investment. Frequently Asked Questions

By understanding the options available through Credit One Home Loans, you can make a well-informed decision that aligns with your financial goals and circumstances. https://www.cuone.org/loans/home/home-loans

Home loans at Credit Union ONE in MI include Conventional Mortgages, Adjustable Rate Mortgages (ARM), FHA Mortgages and VA Loans. Explore loans and rates. https://www.creditonebank.com/articles/what-credit-score-is-needed-to-buy-a-house

HomeReady mortgages help borrowers with low to moderate income buy or refinance a home by reducing down payment and mortgage insurance ... https://www.creditonebank.com/articles/loans-mortgages-credit-cards-after-bankruptcy

And over time, every step you take towards improving your credit score will bring you one step closer to being able to qualify for credit cards ...

|

|---|